What makes FedEx Routes valuable? Find out.

Local delivery industries are growing rapidly, and with them the value of FedEx routes grows as well. Whether you're looking to buy or sell a route, knowing the type of route and fair market value is key. As a qualified Business Valuation Firm, GCF Valuation is here to give you expert information. First things first, determine what kind of FedEx route you're looking at. The two industry sectors: Pick-up and Delivery (P&D) and Line Haul/Long Haul are valued differently. Once you know what sector you're operating in, you're ready for a business valuation. A business valuation is a holistic process that determines how much a business is worth, using both qualitative and quantitative metrics. Not sure if you need a business valuation? Check out our blog to find out why and when you might want to have your business or a business you'd like to acquire, appraised.

What quantitative factors affect the value of FedEx Routes?

Often, FedEx Routes trade and transact on a cash flow multiple. This is because most buyers or investors are most concerned with the cash flow of a company so they can ensure a return on their investment. Earnings before interest, taxes, depreciation, and amortization, or EBITDA, is one of the most common cash flow streams considered when valuing a business and is typically considered the most reliable multiple. Take a look at these other metrics that could change your valuation:

- Current contracts: One influential component of a FedEx route valuation is contract details. A route's individual contract decides the base rate for the number of stops on each route. A higher base rate usually equals higher revenue. That means a higher valuation result.

- Amount and quality of equipment: Routes must have vans, trucks, trailers, and the like to be successful. The value of that equipment is closely considered and is included as part of the business valuation.

- Number of FedEx route employees: Employees are vital to any business. If a route doesn't have many employees, that could be limiting growth.

- Speed: Delivery speed is paramount to the value of delivery service companies. The faster items are delivered, the more stops can be made, increasing the value of the route.

However, local delivery service companies are expanding quickly. That means the competitive landscape could influence pricing and drive profits lower. Business valuations can be complicated, especially in an expanding industry. Reach out to the experts at GCF Valuation to help you navigate the process.

What other factors can change a FedEx Route valuation?

Business valuations are not just about the numbers, though those are very important. There are lots of other pieces of a business that can increase or decrease value besides numbers, too. That's why it's important to find a partner you trust for your business valuation.

- Organization: Most buyers want to purchase a FedEx route as absentee owners. That means they pay someone else to run the company they own. Businesses that operate without the owner drive a higher value than those that need more supervision because there is less dependence on the owner eliminating transition risk to a new owner.

Unlock More FedEx Route Business Valuation Insights with PeerComps

The data in your report is just the beginning. With PeerComps, you can dive deeper into this industry and access accurate, real-time data across multiple sectors. Elevate your decision-making with the powerful combination of experience and data-driven insights.

Keep learning about Business Valuations

- How to Navigate the Business Valuation Process

- Different Types of Business Valuations

Business Valuation Accreditation

Your GCF Business Valuation appraisal team has one or more of the following business valuation accreditations:

Accredited Senior Appraiser (ASA) - is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers)

Accredited Senior Appraiser (ASA) - is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers)

Certified Business Appraiser (CBA) - a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being a difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Business Appraiser (CBA) - a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being a difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Valuation Analyst (CVA)

Certified Valuation Analyst (CVA) Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) - a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) - a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

- Accredited in Business Valuation (ABV) - credential is granted exclusively by the AICPA to CPAs and qualified valuation professionals who demonstrate considerable expertise in valuation through their knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

- Certified Public Accountant (CPA)

Over 25 years of experience and expertise in business valuations and appraisals. An accredited appraiser receives extensive training, remains in good standing, and follows specific industry practices to determine the value of a business.

GCF's Machinery and Equipment Appraisal Accreditations

Expert Equipment Certified Appraiser (EECA) - Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

Expert Equipment Certified Appraiser (EECA) - Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

- Certified Machinery and Equipment Appraiser (CMEA) - a CMEA professional has the expertise and certification to conduct a third party machinery and equipment appraisal.

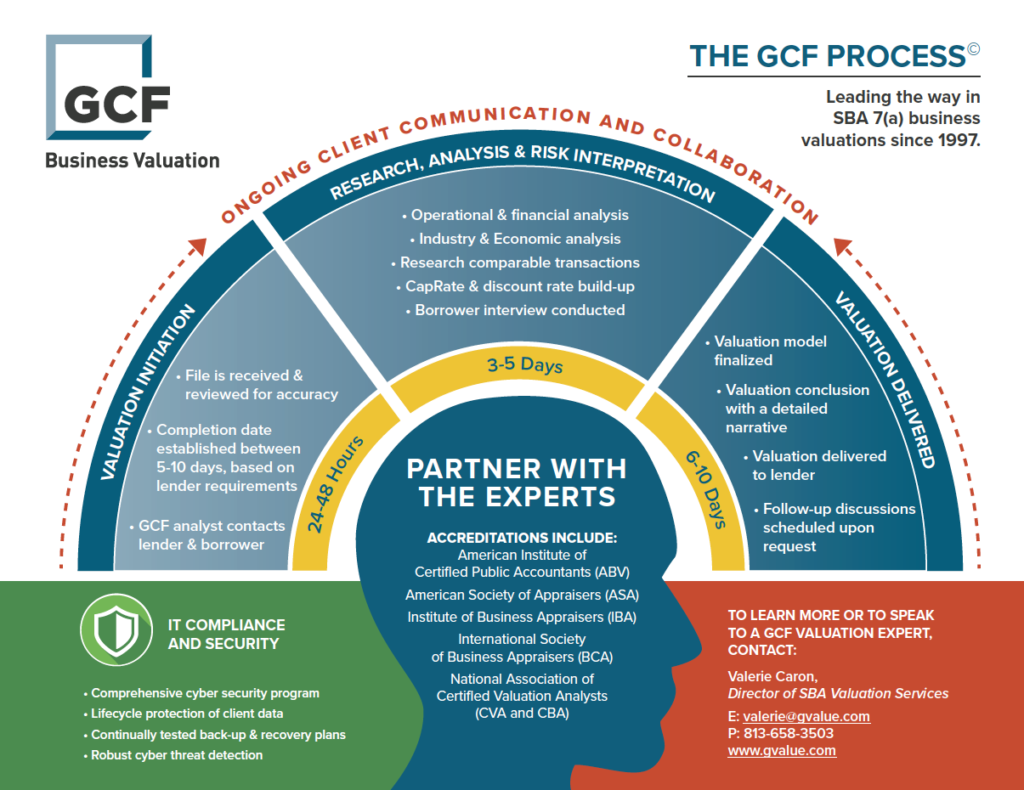

The GCF Business Valuation Process