- Military car insurance offers the same basic coverages as traditional policies, like liability, comprehensive and collision.

- Military members can receive low car insurance rates with USAA or discounts on their military auto insurance policies with providers like Geico.

- Some auto insurance companies provide an emergency deployment discount when you store your vehicle while deployed.

We at the MarketWatch Guides team will explain the nuances and benefits of military car insurance. We’ll also recommend two of the best car insurance companies for service members and their families based on the military discounts and coverage they offer.

Learn more about our methodology and editorial guidelines.

What Is Military Car Insurance?

Military car insurance offers the same coverages you’d find under traditional auto insurance, but with special privileges, programs and discounts suited to military members and their eligible family members.

This isn’t to be confused with insuring military vehicles, which may also be referred to as “military car insurance” in some spaces. For the context of this article, we’re talking about companies that provide worldwide coverage if you take your vehicle with you when you deploy for duty or that give you a discounted policy if you store your car.

Best Military Car Insurance Companies

We recommend USAA as the best car insurance company for military members based on its stellar reputation for customer service, great rates and range of coverages designed specifically for service members. We also recommend Geico — with its above-average military discounts and widespread availability — as a great option for military car insurance.

The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

USAA has the country’s cheapest auto insurance rates on average, and its coverage is exclusively for active or retired military members and their spouses and children. The company consistently receives high scores for customer satisfaction, beating most competitors in the J.D. Power 2024 U.S. Insurance Shopping Study℠.

Additionally, USAA members can earn up to 15% off their comprehensive coverage by garaging their cars on military installations when they deploy. USAA also has a telematics insurance program, USAA SafePilot®, which can help customers save up to 30% off their premiums.

Geico offers qualifying active-duty and former service members a discount of up to 15% off their car insurance premiums. Additionally, policyholders can earn discounts based on emergency deployment and membership in military organizations. Geico also offers tools through its Military Deployment Center that can assist you and your family when you’re preparing for deployment.

Military Car Insurance Discounts

In addition to Geico and USAA, the following insurance companies all offer military discounts:

| Farmers | 10% discount |

| Liberty Mutual | 10% discount |

| Armed Forces Insurance | Varies by state |

| Progressive | Only available in some states |

| Allstate | Varies by state |

| Arbella | 10% discount available in Massachusetts |

You can also earn a discount from Geico if you belong to any of the following military professional organizations.

- Armed Forces Benefit Association

- Association of the United States Army

- Fleet Reserve Association

- Navy League of the United States

- U.S. Naval Institute

In addition, all car insurance companies in Louisiana are required to give active-duty service members 25% off liability, uninsured motorist and medical payments coverage if they live in the state or are deployed elsewhere and have a spouse or dependents who live in the state.

Storage Discounts

Notify your insurance company ahead of time and you may be able to alter your coverage. Some providers offer significant discounts when you store your vehicle while you’re deployed. This may apply to both having your car parked on a military base and having it stored elsewhere while you’re gone.

Other Car Insurance Discounts

Outside of military discounts, most car insurance companies offer a range of other discounts designed to help drivers save money.

Multi-Policy

One of the easiest ways to save on your car insurance is by bundling with other products — home insurance for example. Depending on the company, you can bundle your car insurance with your homeowners, renters, boat and life policies. USAA offers discounts of up to 10% when you bundle your auto coverage with a home or renters policy.

Multi-Car

If you own multiple vehicles, you can get a discount for insuring them all with the same company.

Good Student

High school and college-aged students can receive a discount for earning good grades. Generally, this means carrying a B average or above or scoring in the top 20th percentile nationally for home-schooled students.

Safe Driver

Some insurance companies offer discounts to drivers who don’t have moving violations or accidents for a certain amount of time. It’s also becoming more common for insurance providers to offer discounts through telematics programs that monitor your driving using a telematics device or mobile app. These programs then calculate your discount each term based on how safely and how often you drive.

For example, State Farm offers up to 30% off for using its Drive Safe & Save™ program.

New Car

Since many new vehicles have top-of-the-line safety features like backup cameras and pedestrian detection, insurers will often offer discounts for newer vehicles. Providers typically offer discounts for vehicles that are the current or previous model year. You can check with your insurance company to see its qualifications.

Car Insurance Coverage During Deployments

Drivers who are deployed may not drive their vehicles for weeks or even months and so don’t require max insurance coverage during that time. While it’s possible to cancel the insurance policy for the duration of deployment, this isn’t recommended since the vehicle won’t be covered for any damage that may occur (vandalism or weather damage, for example). Additionally, if the policy is canceled, this will count as a “lapse in coverage” and result in higher rates when it’s reinstated.

This is why some insurance companies offer an emergency deployment discount when you store your vehicle — either on a military base or elsewhere — while deployed. If you have an upcoming deployment, be sure to check with your insurance company to see what options are available.

If you’re not the only one who drives the vehicle, you could also have yourself removed from the policy while you’re away. However, that’s only an option in certain scenarios:

- The vehicle’s registration has both parties’ names on it.

- The car is paid off and doesn’t have a loan or lease in your name only.

- The other person is already on the auto policy.

How Do You Get Military Auto Insurance?

Buying military auto insurance is essentially the same as buying any other type of auto insurance policy. You’ll need to provide information about yourself and the vehicle you plan to insure — and you can do this either online or by contacting an agent.

USAA offers car insurance for active and retired military members and their families and tailors policies to meet the specific needs of military servicemen and women. But as previously shown, many other car insurance companies also offer military packages, so to speak, and military discounts as well.

When shopping for car insurance, be sure to include your military status to see what each company offers in the way of coverage options and discounts.

Who Qualifies for Military Car Insurance?

Each insurance company has its own criteria for who qualifies for military car insurance and discounts. Below are examples of eligibility requirements:

- You’re enlisted in the Army, Air Force, Navy, Marines, Coast Guard or National Guard.

- You’re an active or retired Department of Defense employee.

- You’re a student in one of the service academies or you’re an officer candidate within two years of commissioning.

- You’re an honorably discharged or retired veteran.

- You’re a qualifying family member, such as a spouse, a child (biological, adopted or step), a widow, a widower or a former spouse who hasn’t remarried.

Some providers, like Armed Forces insurance, also offer coverage for retired, former or active commissioned officers of the U.S. Public Health Service or the National Oceanic and Atmospheric Administration.

Factors That Affect Military Car Insurance Rates

Because military car insurance is basically the same as standard car insurance — but with some extra coverages and discounts included — the same factors are used when determining your military car insurance rates. These include:

- Your driving history

- Your garaging address (where your car will be parked overnight)

- The type of vehicle you own

- The coverages you select

- Your credit score (depending on the state)

- Driving behaviors such as annual mileage and whether you use your car for business purposes

Standard Car Insurance Coverages

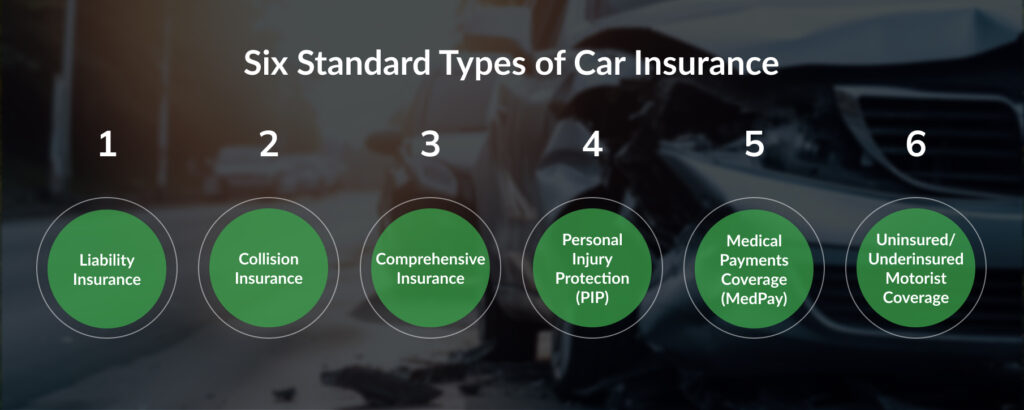

Below are some of the standard types of coverage included in an auto insurance policy:

- Liability Insurance: Liability insurance covers the property damage done to other cars and injuries to other drivers and their passengers from an accident you caused. However, it doesn’t offer financial protection for your vehicle, and it doesn’t cover medical bills for you or your passengers after the crash.

- Collision Insurance: Collision insurance covers the costs to repair or replace your vehicle after it’s been in an accident with another vehicle.

- Comprehensive Insurance: Comprehensive insurance covers damage to your car from things other than an accident — severe weather, falling tree branches, animal collisions, theft, vandalism and the like.

- Personal Injury Protection (PIP): PIP insurance helps cover medical expenses for you and your passengers if you suffer injuries from an accident, regardless of who was at fault. PIP can also cover funeral expenses, as well as lost wages if you have to miss work due to injuries.

- Medical Payments Coverage (MedPay): Similar to PIP, MedPay coverage helps cover injuries to you and your passengers as the result of an accident. It can also help cover your health insurance deductibles and any ongoing treatment you might need.

- Underinsured/Uninsured Motorist Coverage: Underinsured/uninsured motorist coverage (UIM/UM) helps pay for damages if you’re involved in an accident with a driver who has either not enough insurance or no insurance at all. It can also help pay your repair and medical expenses if you’re involved in an accident with an at-fault driver who has insurance but has liability limits too low to cover your costs. UIM/UM is an important coverage to consider, since about 14% of drivers drove without car insurance in 2022, according to the Insurance Information Institute.

Military Car Insurance: The Bottom Line

Military car insurance provides quality coverage and discounted rates to members of the Armed Forces. While many car insurance companies offer a military discount, a few (like USAA and Geico) also offer specialized coverage options designed for the unique car insurance requirements of military members. Whether you’re active duty or retired, be sure to shop around to find the best coverages and discounts available to you.

Best Car Insurance for the Military: FAQ

Below are some frequently asked questions about military car insurance:

Military members might pay cheaper car insurance rates since some providers offer discounts for military service.

Yes, USAA car insurance is only for military members, veterans and their immediate family members. To qualify, you must be an active, retired or former military member earning an Honorable or General Under Honorable Conditions discharge. Family of qualifying members — including spouses, children (biological, adopted and step) and widowers, widows and ex-spouses who haven’t remarried — are also eligible.

Farmers, Liberty Mutual, Armed Forces Insurance, Progressive, Allstate and Arbella all offer discounts for military members. Regional carriers may also offer discounts. That’s why it’s ideal to get car insurance quotes from several providers, as it can give you insight into all of the discounts available to you.

Our Methodology

Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best car insurance companies. We collected data on dozens of auto insurance providers to grade the companies on a wide range of ranking factors. The end result was an overall rating for each provider, with the insurers that scored the most points topping the list.

Here are the factors our ratings take into account:

- Coverage (30% of total score): Companies that offer a variety of choices for insurance coverage are more likely to meet consumer needs.

- Cost and Discounts (25% of total score): Auto insurance rate estimates generated by Quadrant Information Services and discount opportunities are both taken into consideration.

- Industry Standing (20% of total score): Our research team considers market share, ratings from industry experts and years in business when giving this score.

- Customer Experience (15% of total score): This score is based on volume of complaints reported by the National Association of Insurance Commissioners (NAIC) and customer satisfaction ratings reported by J.D. Power. We also consider the responsiveness, friendliness and helpfulness of each insurance company’s customer service team based on our own shopper analysis.

- Availability (10% of total score): Auto insurance companies with greater state availability and few eligibility requirements score highest in this category.

Our credentials:

- 800 hours researched

- 130+ companies reviewed

- 8,500+ consumers surveyed

*Data accurate at time of publication.